ASX ANNOUNCEMENT

18 JANUARY 2023

DECEMBER 2022 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 31 December 2022.

Carly has continued to deliver on key objectives, achieving a material increase in fleet size while maintaining high utilisation which delivered a 72% increase in subscription revenue.

Further to the October/November revenue update announced on 15 December 2022, subscription revenue accelerated in December 2022 to deliver the strongest ever quarter for Carly Car Subscription.

Key highlights include:

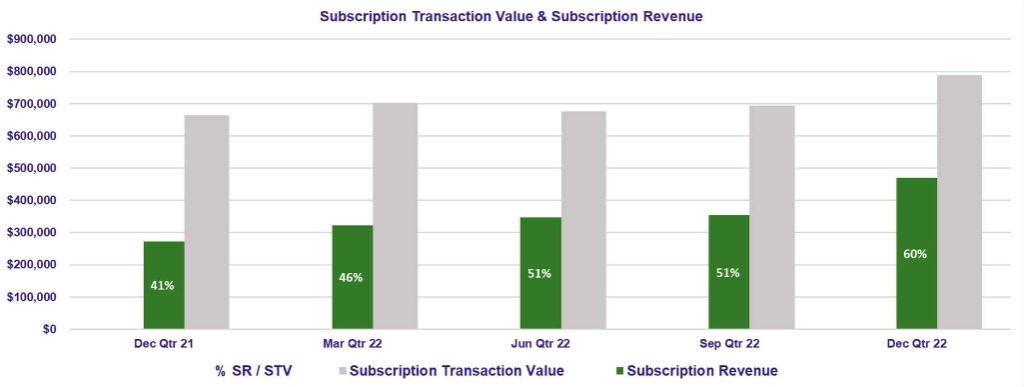

72% increase in Subscription Revenue vs December 2021 Quarter and 33% increase vs September 2022 Quarter

Average Monthly Subscription Revenue reached $156,000 per month in the quarter – a new record for the business and represents an Annualised Run Rate of $2 million (based on $167,000 Subscription Revenue in December 2022)

18% increase in Receipts from Customers vs December 2021 Quarter and 14% increase vs September 2022 Quarter

26% decrease in Net Cash Used in Operating Activities vs December 2021 Quarter and 19% decrease vs September 2022 Quarter (excluding R&D refund)

Subscription Vehicle Utilisation remained at 87% across the December 2022 Quarter, despite the continued addition of new vehicles, demonstrating Carly’s ability to quickly fulfil subscriber demand

6% decrease in Product Manufacturing and Operating Costs vs December 2021 Quarter and 6% decrease vs September 2022 Quarter

56% decrease in Advertising and Marketing vs December 2021 Quarter, stable vs September 2022 Quarter

$1.5m asset finance facility fully utilised and an additional $700,000 secured from new asset finance providers late in December 2022 to support fleet growth

Forward orders were placed for over 100 new vehicles, in anticipation of securing additional asset finance facilities

Substantial progress made in progressing additional material asset finance facilities

Subscription Revenue increased by 33% compared to the September 2022 Quarter driven by upselling to higher value subscription plans, continued growth in the number of subscriptions and a 31% increase in average active subscribers at the end of December 2022, compared to September 2022.

The business strategy to increase the number of owned and financed vehicles, which deliver higher average margins than asset-light vehicles, has resulted in the number of owned and financed vehicles making up 44% of the dedicated fleet at December 2022, compared to 31% at the end of September 2022.

Carly is focused on developing a portfolio of owned, financed and asset-light vehicles in order to have a range of options to access vehicles during different supplier situations, as well as to achieve better control over vehicle availability and fleet size. During the December 2022 quarter, Carly received delivery of all remaining vehicles ordered under the $1.5m asset finance facility announced on 23 June 2022 and was able to introduce the new vehicles into the fleet, whilst maintaining a subscription vehicle utilisation rate of 87% during the December 2022 quarter. This is a revolving facility which is supporting the delivery of additional vehicles in January 2023 and beyond. In addition, in late December 2022 Carly secured $700,000 of new asset finance facilities which had not been utilised at the end of the quarter. Additional asset finance facilities are also currently under negotiation. Carly will continue to apply the same nimble strategy to order, acquire and introduce new vehicles into the fleet. During the quarter Carly placed forward orders for over 100 new vehicles.

In implementing this strategy, Carly is experiencing an improvement in both the growth of subscription revenue and transaction value and a reduction in the average marketing cost, per subscriber. Overall, Advertising and Marketing Costs decreased by 56% compared to the December 2021 Quarter.

These latest results show that Carly is continuing to demonstrate success in three key objectives:

- Securing asset finance facilities that support growth in fleet size

- Securing supply of vehicles in a timely fashion that are then highly utilised

- Increasing overall Subscription Transaction Value and retaining a higher proportion as revenue.

Cash flows during the quarter included payments for:

Research and development costs of $283,000 (YTD: $533,000)

Product manufacturing and operating costs of $579,000 (YTD: $1,192,000)

Advertising and marketing costs of $47,000 (YTD $93,000)

Staff costs of $393,000 (YTD: $749,000)

Administration and corporate costs of $67,000 (YTD $180,000)

Leased vehicles comprising:

Interest amount of $25,000 (YTD: $39,000)

Principal amount of $108,000 (YTD: $170,000).

Further details of the cash flows of the group are set out in the attached Appendix 4C.

Corporate

Payments to related parties and their associates in the December 2022 Quarter of $114,000 related to remuneration of the executive and non-executive directors for the period.

Cash Balance at Quarter End and Funding

At the end of the December 2022 Quarter, the Company maintained a cash balance of $1.62 million, an increase of $1.34 million from the September 2022 Quarter.

On 2 November 2022, Carly announced the completion of the renounceable rights issue, raising $2.11 million before costs.

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Carly Holdings Limited

E: shareholder@carly.co

About Carly Holdings Limited

Carly Holdings Limited (ASX:CL8) investors.carly.co/ is listed on the Australian Securities Exchange. It is Australia’s leading listed company focused on providing innovative mobility solutions for consumers and the automotive industry. Carly Holdings operates www.Carly.co, Australia’s first flexible car subscription service.