FULL YEAR RESULTS: 82% INCREASE IN SUBSCRIPTION REVENUE

ASX ANNOUNCEMENT

30 August 2023

FULL YEAR RESULTS:

82% INCREASE IN SUBSCRIPTION REVENUE

Carly Holdings Limited (ASX:CL8) (Carly or the Company) is pleased to present its Appendix 4E and Annual Report for the year ended 30 June 2023 (FY23).

Carly Holdings ended the 2023 financial year (FY23) with a strongly targeted focus on revenue opportunities in the car subscription market, the securing of asset finance facilities from toptier financiers to support growth in fleet size and the timely delivery of new vehicles that achieved high utilisation. The strategy to reduce previous reliance on asset-light vehicles in favour of financed and leased vehicles which can be more rapidly secured in the current tight vehicle supply market, has delivered more revenue and gross profit.

Significant improvements were recorded in key metrics in FY23 as compared to FY22:

- Subscription Revenue increased by 82%

- Total Revenue increased by 68%

- Gross Profit increased by 74%

- Gross Profit per Subscription increased by 36%

- Subscription Revenue from owned and financed Vehicles reached 64% of Total Revenue compared to 31% in FY22

- 32% growth in overall fleet size, supported by 285% increase in size of owned and financed fleet

Subscription revenue is the income from subscribers, net of external third-party owner fees.

Total revenue includes subscriber revenue, net of external third-party owner fees, plus platform licensing fees.

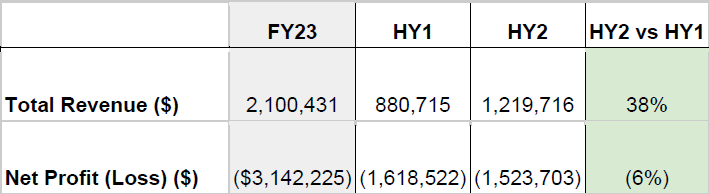

The improvement in business performance accelerated in H2 FY23 vs H1 as the strategic focus on car subscription, supported by an owned and financed fleet, gained significant traction.

Chris Noone, CEO of Carly commented “The strong growth in revenue and gross profit confirms that our strategy is right and we are executing rapidly and effectively. We say what we will do, and we do it. The 38% uplift in H2 revenues shows that our trajectory is increasing rapidly.

Our key utilisation, CPA and efficiency metrics are on target, and combined with our ability to scale the vehicle fleet rapidly whilst maintaining stable corporate and administration expenses, provides a solid foundation for accelerated, profitable growth in FY24. We are focused on exploiting significant opportunities in the consumer, business, government and electric vehicle segments while also supporting automotive OEMs and dealers to expand into the car subscription market.”

Active subscriptions continued to increase during FY23 and the average retention period remained above 5.2 months for the entire year. As Carly grows, it is delivering material

increases in revenue and gross profit through successful implementation of price increases, upselling to higher value subscription plans and retaining an increased share of the subscription transaction value from owned and leased vehicles when compared to ‘asset-light’ vehicles (i.e. vehicles owned by third parties).

Average Subscription Revenue and Gross Profit per Subscription increased by 9.4% and 35.9% respectively in FY23 vs FY22. Achieving high fleet utilisation is a key metric for the business and averaged 86% across FY23.

Carly’s proprietary online customer verification processes and telematics systems continued to de-risk the operation of the fleet and contributed to the receipt of a $60,000 rebate for achieving low claims loss ratio targets for the motor fleet insurance policy.

Carly has traditionally operated an exclusively asset-light vehicle fleet, where third party owners provide vehicles in return for owner fees. Post Covid-19, Carly commenced purchasing and financing vehicles to access more vehicle supply channels and meet the increasing demand for car subscription services. This strategy has been very successful to date, with owned and financed vehicles generating substantially more revenue and gross profit per vehicle compared to vehicles in the asset-light fleet. The owned and financed vehicles continue to perform at a higher utilisation than initial expectations.

The success of the owned and financed fleet strategy emphasises the benefit of securing asset finance facilities to more rapidly expand the fleet size to support accelerated revenue growth.

In March 2023 Carly secured access to an asset finance facility of up to $10m, subject to meeting certain financial covenants, bringing total potential available facilities to $13.2m, an increase of $11.7m since FY22. Carly has continued to utilise the facility and as at June 30, had drawn $2.2m of the facility. Carly will continue to draw down on the facility in FY24, further expanding its owned and financed fleet of vehicles. During FY23 the size of the owned and financed fleet increased by 285% bringing total fleet size to 320 vehicles, of which 34% are asset-light vs 77% at the end of FY22.

Carly continues to seek further asset finance facilities, which have proven to be the optimal method to secure vehicles in a variable supply environment and deliver maximum gross margin.

In FY24 Carly will seek to further accelerate growth of the vehicle fleet, increase marketing and focus business development on opportunities in the consumer, business, government and not-for-profit segments. In particular Carly will leverage opportunities to facilitate the transition to electric vehicles.

Adrian Bunter, Chairman of Carly commented “FY23 was a pivotal year for Carly. The first half of the year was focused on proving the owned and financed strategy was effective and was able to deliver a high utilisation of vehicles, whilst working to secure further finance facilities.

This was confirmed with Carly securing a $10m asset finance facility mid-way through the second half of FY23. The company was able to rapidly secure and deploy the initial stages of that funding, which has continued in FY24. This resulted in a substantial acceleration of revenue growth in the second half of FY23. The business is very well placed for substantial growth in FY24, setting Carly up to be the clear market leader for car subscription in Australia.”

The Company plans to hold the 2023 Annual General Meeting on 16 November 2023. The deadline to receive director nominations is 8 September 2023.

Authorised by:

Chris Noone (CEO and Director)

Carly Holdings Limited

Media Enquiries

The Capital Network

Julia Maguire

+61 2 8999 3699

julia@thecapitalnetwork.com.au

Investor Relations

w: https://investors.carly.co

e: shareholder@carly.co

p: +61 2 8999 3699

About Carly

Carly Holdings Limited (ASX:CL8) is an Australian company leading the growth of the car subscription industry in Australia & New Zealand and supporting the transition to electric

vehicles. Launched in 2019, Carly Car Subscription is a flexible alternative to buying or financing a vehicle, for individuals and businesses, with insurance, registration and servicing included in one monthly payment. Average subscription period is over 5 months. Carly has secured auto industry leaders SG Fleet (ASX:SGF) and Turners Automotive (ASX:TRA) as significant shareholders, joining long-term shareholder, RACV and OEM partner, Hyundai. For more information visit: https://investors.carly.co.

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.