June 2024 Quarterly Activities Report

ASX ANNOUNCEMENT

22 JULY 2024

JUNE 2024 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 30 June 2024.

Carly has continued to deliver on its business objectives, achieving accelerated growth in active subscribers, revenue and fleet size, both YoY and QoQ, while reducing net cash used in operating activities. Growth in revenue was attributed to increases in consumer subscribers, expansion of the corporate customer base and an increase in electric vehicle subscriptions driven by EV Trial. New product launches continued with the deployment of CarlyNow in multiple automotive dealerships.

Key highlights include:

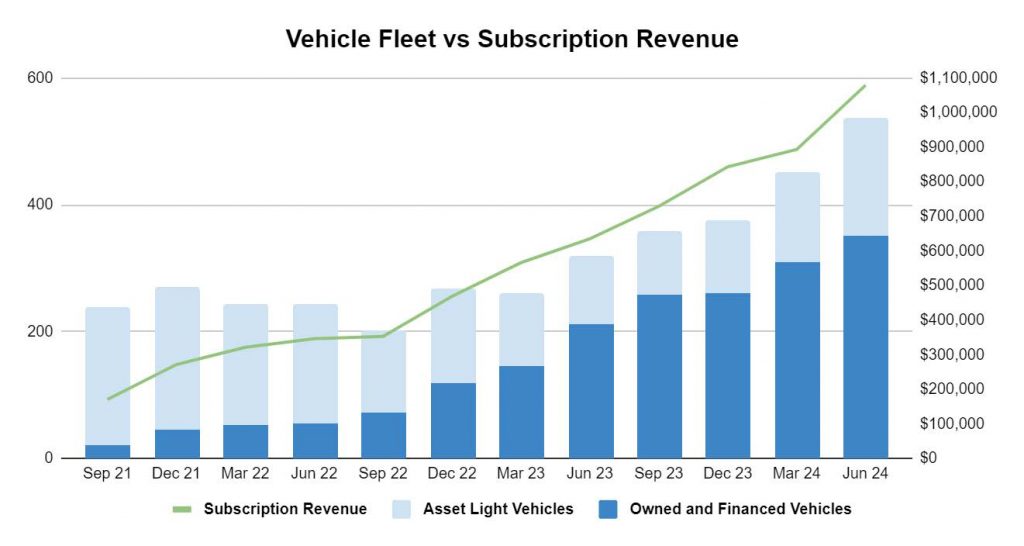

- 69% increase in Subscription Revenue vs June 2023 Quarter, outpacing the 58% growth achieved in the March 2024 Quarter

- 48% increase in Customer Receipts vs June 2023 Quarter, exceeding $1.5 million for the first time

- 7% reduction in net cash used in operating activities vs the June 2023 Quarter and March2024 Quarter, despite additional investment in growth resources

- 37% decrease in staff costs vs March 2024 Quarter and 6% decrease vs June 2023 Quarter

- Receipt of Claims Experience Discount of $13,000 on the motor fleet insurance policy earned as a result of achieving a claims loss ratio below the target threshold, and a reduction in per vehicle insurance premium, improving overall gross profits

- Receipt of an R&D tax incentive rebate of $115,000 before costs

- Total fleet size of 538 which is an increase of 68% vs June 2023 Quarter and 19% vs March2024 Quarter with 87 vehicles added in the June 2024 Quarter

- The asset light fleet increased by 72% vs June 2023 Quarter and 33% vs the March 2024Quarter as more automotive dealers and manufacturers seek subscription monetisation for their vehicles via Carly

- Owned vehicles represented 65% of total fleet size, a reduction from 69% in the March 2024Quarter due to the faster growth of the asset light fleet

- The in-dealer subscription tool, CarlyNow was launched in a number of automotive dealerships during the quarter with deployments continuing in the September 2024 Quarter

The June 2024 Quarter saw a strong uplift in subscription revenue, an increase of 68% compared to the June 2023 Quarter, an improvement on the 58% growth achieved in the March 2024 Quarter (vs March Quarter 2023). Subscription revenue grew by 20% vs the March 2024 Quarter as recent asset heavy vehicle purchases were taken up by a larger number of consumer subscribers and a broadening base of corporate customers. Much of the growth in the June 2024 Quarter occurred in the month of June 2024 and has continued strongly into July 2024. In the corporate sector, Carly has identified a number of industry segments that have a higher propensity for use of subscription vehicles due to the nature of demand or employee situation. Following success with early customers in these segments, Carly is signing up multiple similar customers.

EV Trial www.evtrial.com.au, a simple and cost-effective way for car buyers to try an EV before they buy, continued to expand in the June Quarter, supported by the addition of owned and asset light electric vehicles. Corporate referral relationships have been established to drive demand for EV Trial for Business. There has been strong interest from a number of manufacturers and distributors in providing their vehicles for EV Trial under the asset-light model.

Fleet size growth continued at a similar pace to the prior quarter, with 19% growth vs March 2024 Quarter and 68% growth in the 12 months to June 2024. The proportion of asset light vehicles increased from 31% in March 2024 to 35% in June 2024, reversing the trend of an increasing proportion of owned vehicles which had been evident since Covid supply issues were first apparent.

As highlighted in previous updates, Carly is witnessing a softening in the retail new car sales market as post Covid supply delays have largely been resolved and cost of living pressures weaken demand for new vehicle purchases. Both of these impacts are positive for Carly, increasing the potential supply of asset light vehicles as automotive dealers and manufacturers seek alternative revenue streams for excess vehicles and, on the demand side, consumers and businesses delay financing new vehicle purchases and opt for the lower risk and more flexible subscription option.

As indicated last quarter, the revenue growth from new additions to the fleet of asset heavy vehicles lags the vehicle additions and results in an increase in costs prior to the commencement of subscriptions. Having added a significant number of vehicles during the June Qtr, Carly is well placed for material revenue and subscription growth in coming quarters without further increases in costs.

The Claims Experience Discount received in relation to the motor fleet insurance policy was earned as a result of achieving a claims loss ratio below the target threshold. Carly conducts stringent processes to verify customers before a subscription is approved and telematic systems are used to monitor vehicles in the field. These processes and systems form part of Carly’s proprietary PeerPass platform which utilises AI and other tools to drive optimum outcomes for subscribers and vehicle condition. This strong performance has also resulted in Carly receiving a reduction in vehicle insurance premiums upon renewal of its policy taking effect in May which will further improve subscription profitability in the coming year. This compares favourably to the broader insurance market which saw increases in motor vehicle insurance premiums.

CarlyNow was deployed in multiple dealerships in the June Quarter and launches continue in the current quarter. CarlyNow enables automotive dealers to subscribe vehicles to customers who visit their dealership by leveraging Carly’s technology and operational expertise. A subscription can be created ‘on the fly’ by adding subscriber and vehicle details. Carly performs ID verification and affordability checks, processes payments, applies insurance to the vehicle and provides fleet management services. CarlyNow was developed to broaden customer acquisition channels and support growth of the asset light fleet.

Significant reductions were achieved in Staff Costs, reducing by 37% compared to the March 2024 Quarter and now reflecting the expected ongoing run rate. Product Manufacturing & Operating Costs increased as a natural consequence of a larger fleet and timing related items such as annual registration renewals (66 vehicles acquired June 2023 Quarter) and third party owner costs expensed in the prior quarter but invoiced and paid in the June 2024 Quarter. Corporate Costs increased due to R&D tax incentive refund consultant fees and half yearly audit costs.

Corporate

Payments to related parties and their associates in the June 2024 Quarter of $105,000.

Cash Balance at Quarter End and Funding

At the end of the June 2024 Quarter, the Company maintained a cash balance of $1,313,000, a decrease of $1,231,000 from the March 2024 Quarter. The reduction in available cash was due primarily due to the acquisition of new vehicles across the June 2024 Quarter, totalling $2,080,000.

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

Media Enquiries

The Capital Network

Julia Maguire

+61 2 8999 3699

E: julia@thecapitalnetwork.com.au

Investor Relations

W: investors.carly.co

E: shareholder@carly.co

About Carly

Carly Holdings Limited (ASX:CL8) is an Australian company leading the growth of the car subscription industry in Australia & New Zealand and supporting the transition to electric vehicles. Launched in 2019, Carly Car Subscription is a flexible alternative to buying or financing a vehicle, for individuals and businesses, with insurance, registration and servicing included in one monthly payment. Average subscription period is over 5 months. Carly has secured auto industry leaders SG Fleet (ASX:SGF) and Turners Automotive (ASX:TRA) as significant shareholders, joining long-term shareholder, RACV and OEM partner, Hyundai. For more information visit: https://investors.carly.co.