ASX ANNOUNCEMENT

31 JANUARY 2022

DECEMBER 2021 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 31 December 2021.

Key highlights include:

22% increase in Receipts from Customers vs. September 2021 Qtr

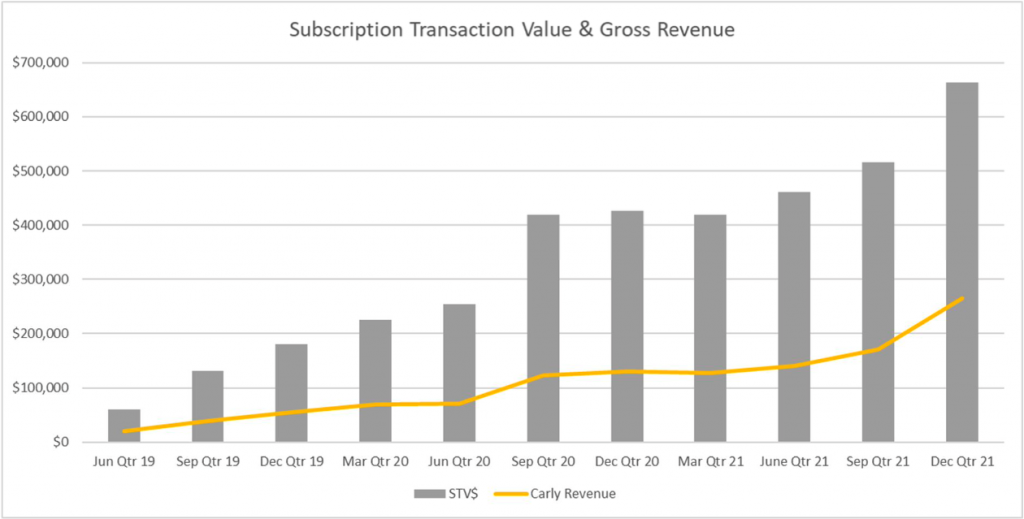

28% increase in Subscription Transaction Value vs September 2021 Qtr and 56% increase vs December 2020 Qtr

55% increase in Carly Revenue vs September 2021 Qtr and 69% increase vs December 2020 Qtr

Carly Revenue from Owned and Leased Vehicles increased by 440% vs September 2021 Qtr and contributed 28% of Total Carly Revenue

Carly Subscription increased to 89% of Rental & Subscription Receipts vs 82% in the September 2021 Qtr

Carly Revenue increased to 40% of Subscription Transaction Value vs 33% in the September 2021 Qtr

34% reduction in Net Cash Used in Operating Activities vs the September Qtr and 10% reduction vs the December 2020 Qtr

29% reduction in Research & Development Costs vs the September Qtr

6% reduction in Product Manufacturing Costs vs the September Qtr, despite 22%

increase in Receipts from Customers15% reduction in Staff Costs vs the September 2021Qtr

24% reduction in Administration & Corporate Costs vs the September 2021 Qtr.

Despite the re-emergence of Covid-19 uncertainty with the onset of the Omicron variant, Carly Car Subscription continued to achieve strong growth across key metrics versus the September 2021 Quarter. Subscription Transaction Value increased by 28% and Carly Revenue increased by 55% compared to the September 2021 Quarter. The higher increase in Carly Revenue compared to Subscription Transaction Value is due to the implementation of the strategy to bring owned and leased vehicles into the fleet, in addition to vehicles secured through the traditional asset light model. Under the new vehicle acquisition strategy Carly retains a higher proportion of the Subscription Transaction Value as revenue, which increased to 40% in the December 2021 Quarter vs 33% in the September 2021 Quarter. Carly Subscription receipts increased to 89% of Rental & Subscription Receipts, an increase of 7% since the September 2021 Quarter as the Company continues to reduce its focus on the more volatile car rental and rideshare rental revenue streams.

As previously announced, a new subsidiary of Carly Holdings was established to control vehicles, via owning and financing, to provide a more reliable source of vehicles to match the increasing level of demand and achieve the substantial growth potential of car subscription. As of 31 December 2021, 46 vehicles were owned or leased and contributed 28% of Total Carly Revenue. This is an increase from 24 vehicles owned or leased as at 30 September 2021. The utilisation of owned and leased vehicles is currently ahead of initial modelling and expectations.

While the Carly revenue from owned/leased vehicles increased by 440% in the December 2021 Quarter versus the September 2021 Quarter, the quarterly results alone do not fully reflect the rapid growth in revenue and utilisation that was attained by the month of December 2021. The revenue for the month of December 2021 for owned/leased vehicles was 58% higher than the average monthly revenue recognised for the December 2021 Quarter. Given the recurring nature of a Carly Car Subscription, the revenue generated by these vehicles can be expected to continue into the March 2022 Quarter.

Over the last two quarters, Carly has sought to confirm the thesis that it can acquire high demand vehicles, quickly have them subscribed by customers and generate a strong return on those assets. Given the performance to date, Carly has proven this thesis, and will look to expand the fleet of owned and leased vehicles.

The ongoing focus on cost control delivered substantial savings in all cost areas except Advertising and Marketing which increased by a modest 18% vs the September 2021 Quarter as Carly increased marketing with the easing of restrictions and improved vehicle supply. Total cash outflow for expenses reduced by 12% in the quarter vs the September 2021 Quarter.

Corporate

As announced on 6 August 2021 Carly Holdings Limited proposed to undertake the selective buy-back and cancellation of 800,000 fully paid ordinary shares (on a post-consolidation basis) (Collateral Shares) issued under the controlled placement deed with Acuity Capital (CPD), the details of which were announced on 10 January 2019. Under the CPD with Acuity Capital, the Company had access to up to $3,000,000 of equity over a 30-month period. As noted in the Quarterly Activities Report released to the ASX on 29 July 2021, the CPD expired on 31 July 2021. In accordance with the terms of the CPD, the Company and Acuity Capital have entered into a buy-back agreement in order for the Company to buy-back and cancel the Collateral Shares for nil consideration (Buy-Back). Shareholder approval was received at the annual general meeting (AGM) held on 18 November 2021 and the buy-back was completed on 19 November 2021.

On 3 December 2021 Carly Holdings Limited issued 8,185,125 fully paid ordinary shares and 2,728,374 quoted options exercisable at $0.16 per option, with an expiry date of 31 May 2023 raising $0.65 million under the Tranche 2 Placement. Shareholder approval was received at the AGM for major shareholders of the Company, SG Fleet Management Pty Limited and Willoughby Capital Pty Ltd as trustee for the Willoughby Capital Trust, to participate in the Tranche 2 Placement.

During the quarter, Carly Holdings Limited transferred $200,000 to a restricted cash account to provide security associated with the provision of a vehicle leasing facility. This is disclosed as a cash outflow in “Cash flows from investing activities”. The restrictions on these funds will be released upon completion of the leasing facility.

Payments to related parties and their associates in the December 2021 Quarter of $106,000 related to remuneration of the executive and non-executive directors for the period.

Cash Balance at Quarter End and Funding

At the end of the December 2021 Quarter, the Company maintained a cash balance of $2.09 million, a decrease of $0.35 million from the September 2021 Quarter.

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Carly Holdings Limited

About Carly Holdings Limited

Carly Holdings Limited is listed on the Australian Securities Exchange (ASX:CL8). It is Australia’s leading listed company focused on providing innovative mobility solutions for consumers and the automotive industry. Carly Holdings operates www.DriveMyCar.com.au Australia’s leading peer-to-peer car rental business, and www.Carly.co, Australia’s first flexible car subscription service.