ASX ANNOUNCEMENT

29 JULY 2021

JUNE 2021 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 30 June 2021.

Key highlights include:

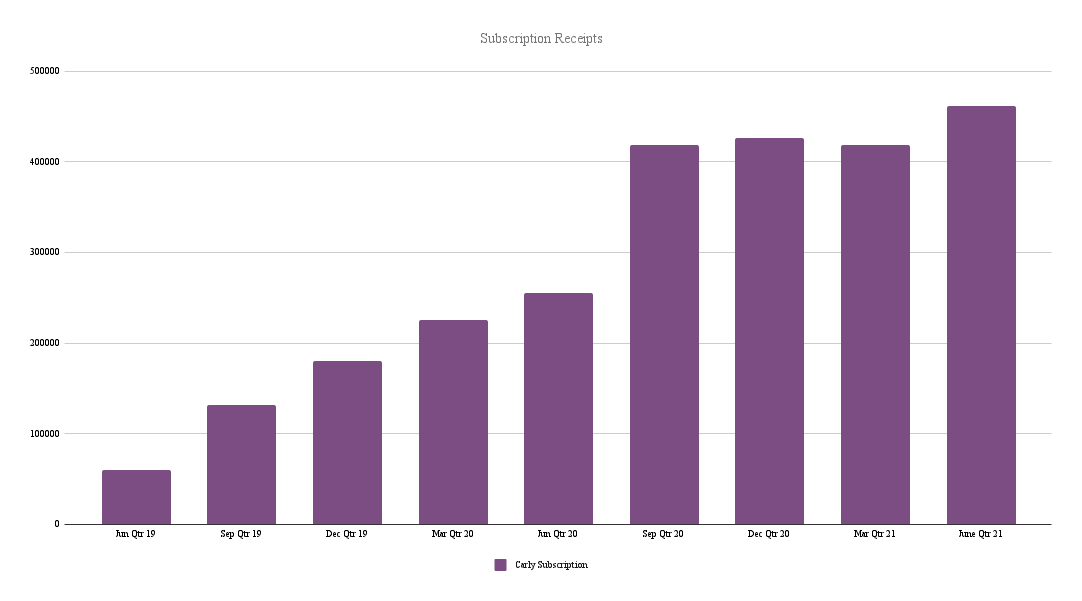

- 9% increase in Cash Receipts vs March 2021 Qtr and 46% increase vs June 2020 Qtr

- 10% increase in Subscription Transaction Value vs March 2021 Qtr and 81% increase vs June 2020 Qtr

- Subscription retention period increased to 5.7 months in June 2021 vs 5.3 months in March 2021

- Carly Subscription increased to 68% of Rental & Subscription Receipts in the June 2021 Quarter vs. 62% in March 2021Quarter

- 18% decrease in Net Cash Used in Operating Activities vs March 2021 Qtr and 36% decrease vs June 2020 Qtr

- Over $91,000 reduction in Administration & Corporate Costs, Advertising & Marketing Costs and Product Manufacturing & Operating Costs vs March 2021 Qtr

- Elimination of $34,600 of monthly recurring costs during the June 2021 Quarter via staff reduction and termination of marketing agency contracts, the benefit of which will be fully realised from July 2021

- Receipt of the maximum Claims Experience Discount of $67,000 for the motor fleet insurance policy due to beating claims loss ratio targets in the 2020/21 period

- Completion of the 3-for-4 Renounceable Rights Issue announced on 15 April 2021 which closed significantly oversubscribed and raised a total of $4.85 million including the Follow-On Placement

- Commencement of the strategy to leverage new funding to more directly secure vehicles with the establishment of a new subsidiary of Carly Holdings Limited and the purchase of vehicles during the June 2021 Quarter.

Carly Car Subscription continued to achieve growth in all key metrics despite the ongoing impacts of Covid-19 and limited supply of new vehicles. The car subscription revenue stream, which was initiated in March 2019, has proven to be resilient in the face of significant challenges in the economy and now accounts for 68% of total transaction value. The average retention period for subscriptions continues to increase and has reached a new peak of 5.7 months.

During the June 2021 Quarter, in response to the vehicle supply restrictions, the potential for ongoing Covid-19 restrictions and an ongoing focus on efficiency of costs, a number of cost reduction measures were adopted via staff reductions and the termination of marketing agency contracts. All marketing activities are now managed internally and other responsibilities have been re-allocated to existing staff. Significant savings were also achieved in Administration & Corporate Costs and Marketing Expenses.

As detailed in the March 2021 Quarterly Activities Report released on 28 April 2021, access to a more reliable source of vehicles to match the high level of demand is essential to achieve the substantial growth potential of car subscription. During the June 2021 Quarter a new subsidiary of Carly Holdings was established to control vehicles, via owning and financing. As part of the shift in vehicle supply strategy, 16 new and used Toyota, Kia, Hyundai and MG vehicles were ordered in June 2021 for delivery in July and August 2021. Carly anticipates being able to secure additional vehicles via a financing facility in the near future.

Corporate

On 12 May 2021 Carly Holdings Limited reported that the renounceable rights issue announced on 15 April 2021 closed significantly oversubscribed and raised $3,392,115 (Rights Issue) with major shareholders of the Company, SG Fleet Management Pty Limited (SG Fleet) and Willoughby Capital Pty Ltd as trustee for the Willoughby Capital Trust (Willoughby), taking up their entitlements of over $1.50 million. To accommodate a portion of excess demand, the Company agreed to undertake a placement to raise an additional $1,454,810 on the same terms as the rights issue (Follow-on Placement).

The total amount raised from the Rights Issue and Follow-on Placement was $4.85 million, before costs, of which $0.65 million relates to subscriptions under Tranche 2 of the Follow-on Placement by SG Fleet and Willoughby, the completion of which is subject to receipt of shareholder approval by 30 November 2021.

The funds from the Rights Issue and Follow-on Placement will be used primarily to fund growth in the supply of vehicles available for subscription, demand generation and working capital. As previously announced, Carly intends to allocate the capital to enable it to leverage the funds to deliver a significant increase in supply of vehicles, such that Carly will have an increased level of control over the availability and deployment of vehicles, enabling Carly to better address the significant demand for subscription vehicles and deliver stronger growth in revenues.

As announced to ASX on 10 January 2019, the Company has a controlled placement deed with Acuity Capital for up to $3,000,000 of equity (Facility) over a 30-month period which will expire on 31 July 2021. Subject to all necessary regulatory and shareholder approvals, the Company intends to buy-back and cancel 800,000 collateral shares (on a post-consolidation basis) issued under the Facility for nil consideration. The Company will provide a further update once it enters into a buy-back agreement with Acuity Capital.

Payments to related parties and their associates in the June quarter of $110,000 related to remuneration of the executive and non-executive directors for the period.

Cash Balance at Quarter End and Funding

At the end of the June 2021 Quarter, the Company maintained a cash balance of $3.73 million, an increase of $3.2 million from the March 2021 Quarter. A further $0.65 million is expected to be received from the major shareholders in the December 2021 Quarter, following receipt of shareholder approval of Tranche 2 of the Follow-on Placement.

The Directors continue to closely monitor cash flows and funding requirements and are assessing all funding alternatives, which may include a placement to strategic and/or high net-worth investors to ensure that the Company can continue to pursue the growth opportunities of the businesses. In response to the potential impact of COVID-19, Carly has taken a prudent approach to cash management and proactively implemented a range of cost-saving measures. The Company will continue to review the cost structure of the business to ensure that it is appropriate.

This announcement was authorized to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Carly Holdings Limited

About Carly Holdings Limited

Carly Holdings Limited (ASX:CL8) www.carly.co/investors is listed on the Australian Securities Exchange. It is Australia’s leading listed company focused on providing innovative mobility

solutions for consumers and the automotive industry. Carly Holdings operates www.DriveMyCar.com.au Australia’s leading peer-to-peer car rental business, and www.Carly.co, Australia’s first flexible car subscription service.