ASX ANNOUNCEMENT

28 MARCH 2021

MARCH 2021 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 31 March 2021.

Key highlights include:

- Subscription retention period increased from 5.2 months in December 2020 to 5.3 months in March 2021

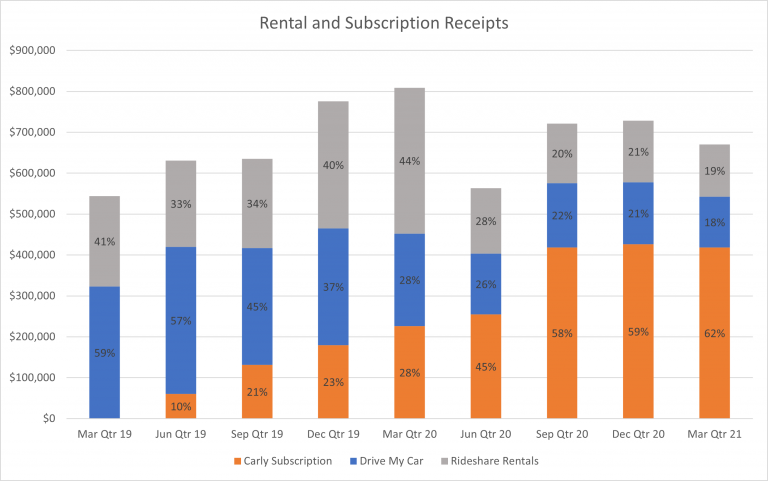

- Carly Subscription increased to 62% of Rental & Subscription Receipts in the March 2021 Quarter vs. 28% in March 2020 Quarter

- Corporate vehicle utilisation days, increased from 82% in Dec 2020 Qtr to 83% in Mar 2021 Qtr

- 25% decrease in Advertising and Marketing costs vs. December 2020 Quarter

- 5% decrease in Staff costs vs. December 2020 Quarter

- 85% increase in Subscription Transaction Value vs. March 2020 Quarter and 2% decrease vs. December 2020 Quarter

- Significant improvements achieved in claims on the motor fleet insurance policy in the year ended 21 March 2021:

– 25% reduction in Claims Loss Ratio

– 9.1% reduction in motor fleet insurance premium for 2021/22

– Maximum Claims Experience Discount achieved – 115% higher than 2019/20 policy year

– 28% reduction in insurance claims in year ended 21 March 2021 vs 2019/20 policy year - 3-for-4 Renounceable Rights Issue to raise up to $3.39 million announced on 15 April 2021. With every 3 New Shares, shareholders receive 1 free attaching New Option.

Major shareholders SG Fleet and Willoughby Capital intend to take up their full entitlements in excess of $1.5 million. The minimum subscription under the Rights Issue is

$3.15 million. - Carly is continuing to navigate the current temporary shortage of vehicles due to the impacts of COVID-19. The Board is encouraged by the continuing strong interest in Carly and car subscription expressed by manufacturers, dealers and other vehicle owners and look forward to improved conditions when the vehicle supply market

returns to more normal operations. In the meantime, Carly will seek to leverage new funding to more directly secure vehicles to satisfy demand, which currently exceeds

supply.

Growth of Carly Car Subscription, DriveMyCar and rideshare rentals continued to be hampered in the March 2021 Quarter due to restricted supply of vehicles. The COVID-19

pandemic continues to cause significant disruption to global automotive supply chains, resulting in a deficit of new cars in Australia and a substantial increase in the price of used cars. The limited supply of vehicles is being experienced by automotive dealers, corporate fleets and Carly alike. Despite these challenges, Carly has been successful in retaining its core fleet of vehicles provided by automotive manufacturers, dealers and fleet management organisations, however it continues to be difficult to secure significant additional vehicles to keep pace with the level of demand.

The global vehicle supply disruptions that have occurred as a result of COVID-19, and the additional lockdowns in the March 2021 Quarter in various Australian cities meant that the consecutive increases in Cash Receipts from Customers achieved in the previous two quarters were not sustained in the March 2021 Quarter, despite continuing strong demand. New vehicles were added to the platform in the March 2021 Quarter, however not at a rate to service demand. Results in the December 2020 Quarter also reflected higher demand for rental vehicles and increased prices during the summer holiday period.

The Board is cognisant of the large opportunity for car subscription and that it is a critical element of the business model to secure a reliable source of vehicles to match the high level of demand. The directors recognise that a change to the vehicle supply strategy is required to ensure the growth potential of the car subscription business is realised. Following the successful completion of the Renounceable Rights Issue and as announced on 15 April 2021, Carly intends to deploy a portion of the capital raised to secure vehicles for a medium/long term period. This may involve indirect control of vehicle supply, direct purchase, lease or a combination of these approaches. This will be in addition to the existing vehicle supply model whereby vehicle providers retain ownership of their assets. Greater control of vehicles will enable Carly to retain a higher proportion of subscription value as revenues which enable more funds to be allocated to vehicle handover and management and business growth. Using the past subscription and search criteria, Carly expects to be able to better identify, control and price vehicles that should result in higher demand and utilisation of assets and, in turn, increased revenues for the car subscription business.

Carly will manage the vehicles secured under the new strategy and intends to establish ‘high street’ retail handover locations, the first of which is planned for the inner west of Sydney. This location will replace the existing airport handover facility. This shift in vehicle supply strategy should enable Carly to manage the subscription lifecycle more effectively and provide an excellent opportunity to develop the Carly brand image through a branded location.

Consolidated Cash Flows

Strong demand and restricted supply resulted once again in high corporate vehicle utilisation days of 83% in the March 2021 Quarter, the highest utilisation rate achieved to

date. A number of vehicle categories achieved close to 100% utilisation.

Carly Subscription increased to 62% of Rental & Subscription Receipts in the March 2021 Quarter vs. 28% in the March 2020 Quarter, once again reflecting the continued strong performance of Carly car subscription and its increasing importance to overall group revenues.

Subscription retention period increased from 5.2 months in December 2020 to 5.3 months in March 2021, reflecting the long-term appeal of the Carly car subscription proposition.

In recognition of the current vehicle supply constraints, strong organic demand and recurring nature of subscriptions, Advertising & Marketing costs decreased 25% compared

to the December 2020 Quarter. Since the June 2020 Quarter, Advertising & Marketing costs have been reduced by 57%, whilst seeing continued strong performance in subscription revenues. Furthermore, some external marketing providers were terminated in March 2021 and the functions brought in house, resulting in an ongoing saving of $12,500 per month in fixed costs from April 2021 onwards. Carly intends to review Advertising and Marketing activities once the new vehicle supply strategy is underway.

Carly achieved significant improvements in claims on their motor fleet insurance policy in the year ended 21 March 2021. The operational improvements are a result of enhancements to the PeerPass verification platform and the transition from the rental model to the subscription model which delivers a lower risk profile for vehicle usage.

The Claims Loss Ratio, which measures the value of claims as a percentage of insurance premium paid, reduced from 64% in 2019/20 to 38.9% in the 2020/21 policy year which ended on 21 March 2021.

Due to this achievement the motor fleet insurance premium for the 2021/22 policy year has been reduced by 9.1%. This reduction was achieved despite a general increase in motor insurance premiums across the industry.

The continuing transition to the subscription model is expected to deliver further Claims Experience Discounts and insurance premium reductions in future periods. Insurance costs make up a significant proportion of cost of sales and the Claims Experience Discount and insurance premium reductions will support improvements in unit economics and gross margin in future periods.

Payments to related parties and their associates in the March quarter of $70,000 related to remuneration of the executive and non-executive directors for the period.

Corporate

On 15 April 2021, the Company announced the launch of a 3-for-4 renounceable rights issue offer to raise up to $3.39 million (Rights Issue). Participants in the Rights Issue will receive a free attaching option on a 1-for-3 basis. The free attaching options will be exercisable at $0.16 each and expire on 31 May 2023 (New Options). The Company has applied for the New Options to be quoted on ASX. The minimum subscription under the Rights Issue is $3.15 million and major shareholders of the Company, namely SG Fleet Management Pty Limited and Willoughby Capital Pty Ltd as trustee for the Willoughby Capital Trust, intend to take up their rights totalling in excess of $1.5 million. Mahe Capital advised on the Rights Issue and acts as Lead Manager.

Rights can be traded under ASX ticker code CL8R and trading ends on 30 April 2021. The Rights Issue is due to close on 7 May 2021 and securities are expected to be issued on or around 14 May 2021.

Cash Balance at Quarter End and Funding

At the end of the March 2021 Quarter, the Company maintained a cash balance of $530,000, a decrease of $795,000 from the December 2020 Quarter.

The Directors closely monitor cash flows and funding requirements and are assessing all funding alternatives, which may include a placement to strategic and/or high-net-worth investors to ensure that the Company can continue to pursue the growth opportunities of the businesses. In response to the potential impact of COVID-19, Carly has taken a prudent approach to cash management and proactively implemented a range of cost saving measures. The Company will continue to review the cost structure of the business to ensure that it is appropriate.

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Carly Holdings Limited

About Carly Holdings Limited

Carly Holdings Limited (ASX:CL8) www.carly.co/investors is listed on the Australian Securities Exchange. It is Australia’s leading listed company focused on providing innovative mobility

solutions for consumers and the automotive industry. Carly Holdings operates www.DriveMyCar.com.au Australia’s leading peer-to-peer car rental business, and www.Carly.co, Australia’s first flexible car subscription service.