ASX ANNOUNCEMENT

17 OCTOBER 2022

SEPTEMBER 2022 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 30 September 2022.

Carly has continued to deliver on key objectives, having achieved material increases in revenue and vehicle utilisation, significant reductions in customer acquisition costs and placed orders for up to $1.5m of vehicles, of which 30% were delivered in the September 2022 Quarter. Combined, these results contributed to a substantial reduction in net cash outflows.

Key highlights include:

- 40% decrease in Net Cash Used in Operating Activities (excluding receipt of R&D Tax Incentive Refund in July 2022) vs September 2021 Quarter and 17% decrease vs June 2022 Quarter

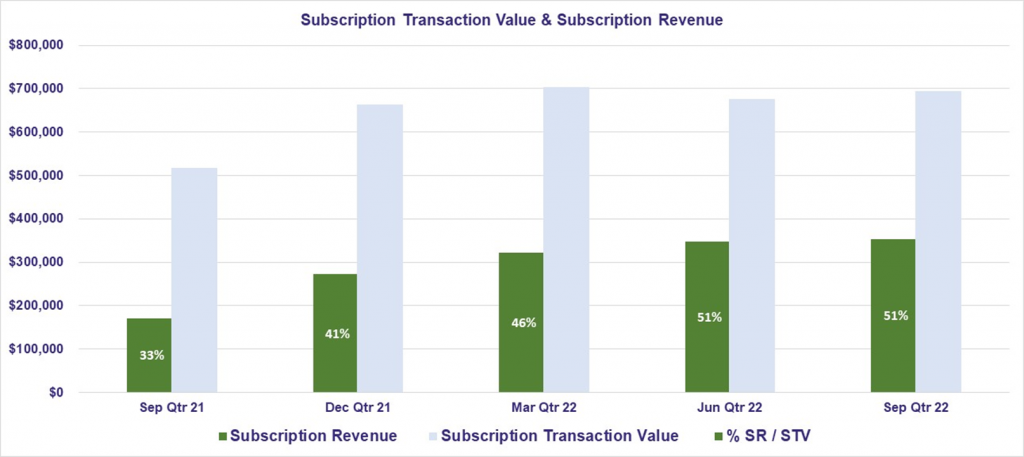

- 108% increase in Subscription Revenue vs September 2021 Quarter

- 27% increase in Receipts from Customers vs September 2021 Quarter

- Subscription Vehicle Utilisation reached 87% in the September 2022 Quarter, an 11% increase vs 76% utilisation in the September 2021 Quarter

- 23% decrease in Research & Development and 19% decrease in Staff Costs vs September 2021 Quarter

- 7% decrease in Product Manufacturing and Operating Costs vs September 2021 Quarter and 14% decrease vs June 2022 Quarter

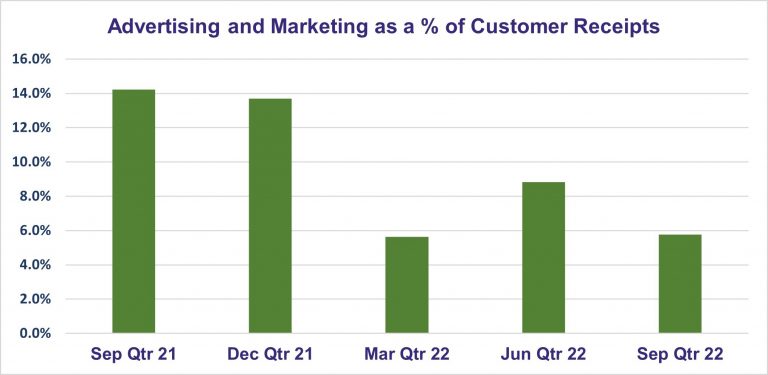

- 49% decrease in Advertising and Marketing vs September 2021 Quarter and 36% decrease vs June 2022 Quarter

- 30% of vehicles ordered under the $1.5m asset finance facility announced in June 2022 were delivered and highly utilised in the September Quarter with the remaining 70% of vehicles expected to be delivered in the December 2022 Quarter

During the September 2022 Quarter Net Cash Used in Operating Activities decreased by 40% compared to the September 2021 Quarter after accounting for the receipt of the R&D Tax Incentive Refund in July 2022. This positive outcome was achieved through increases in sales, higher utilisation of vehicles and a broad reduction in expenses.

Subscription Revenue increased by 108% compared to the September 2021 Quarter driven by increases in average selling prices, upselling to higher value subscription plans and an overall increase in the number of subscriptions. The increase in Subscription Revenue was proportionally higher than the 27% increase in Receipts from Customers due to an increase in the number of owned and financed vehicles which deliver higher margins than asset-light vehicles.

Maximising return on investment and efficiency improvements have been a key focus of the business and success in this area is evidenced by the substantial improvement in vehicle utilisation and reduction in marketing costs. Subscription Vehicle Utilisation reached 87% in the September 2022 Quarter, an 11% increase compared to the September 2021 Quarter, due to the strong demand for the vehicles which Carly acquired specifically for subscription use. High utilisation was also supported by improvements to digital marketing campaigns and search engine optimisation which delivered more subscription bookings at lower cost. Marketing campaign optimisation contributed to a reduction in customer acquisition costs. Overall, Advertising and Marketing Costs decreased by 49% compared to the September 2021 Quarter.

Immediately upon securing the $1.5m asset finance facility announced on 23 June 2022, Carly set about seeking deliveries of suitable vehicles in the shortest possible time frame. Due to ongoing Covid-19 impacts, Ukraine conflict, microchip shortages and shipping delays, the supply of new cars to Australia has been disrupted and delays of up to 12 months are common. During the September 2022 Quarter, Carly identified and placed orders for vehicles that would utilise the entire asset finance facility. Carly received delivery of 30% of the vehicles available under the asset finance facility in the September 2022 Quarter, with the remaining vehicles due to be delivered in the December 2022 Quarter. Carly’s nimbleness and strong automotive industry relationships ensured that cars were delivered more quickly than would be expected, given the supply constraints. The new vehicles were rapidly subscribed after delivery and contributed to the high overall utilsation rate. The full benefit of the subscription of these vehicles will be seen in the December 2022 Quarter and beyond.

Cash flows during the quarter included payments for:

- Research and development costs of $250,000 (YTD: $250,000)

- Product manufacturing and operating costs of $613,000 (YTD: $613,000)

- Advertising and marketing costs of $46,000 (YTD $46,000)

- Staff costs of $356,000 (YTD: $356,000)

- Administration and corporate costs of $113,000 (YTD $113,000)

- Leased vehicles comprising:

- Interest amounts of $16,000 (YTD: $16,000)

- Principal amounts $60,000 (YTD: $60,000).

Further details of the cash flows of the group are set out in the attached Appendix 4C.

Corporate

Payments to related parties and their associates in the September 2022 Quarter of $80,000 related to remuneration of the executive and non-executive directors for the period.

Cash Balance at Quarter End and Funding

At the end of the September 2022 Quarter, the Company maintained a cash balance of $0.28 million, a decrease of $0.53 million from the June 2022 Quarter.

On 5 October 2022, Carly announced the launch of a renounceable rights issue to raise up to $2.8 million. The Rights Issue is intended to primarily fund growth in car subscription revenue from consumer and business markets, technology enhancements, R&D and for working capital. The minimum subscription under the Rights Issue is $2.0 million.

Major shareholders and officers of the Company have confirmed their intention to take up rights under the Rights Issue totalling over $700,000, namely SG Fleet Management Pty Limited and Willoughby Capital Pty Ltd as trustee for the Willoughby Capital Trust, Turners Automotive Group Limited and directors, Chris Noone and Adrian Bunter.

Eligible Shareholders who subscribe for their full Entitlement can also apply for shortfall in excess of their entitlement. Shareholders can also trade their rights under ASX ticker code CL8R until Wednesday, 19 October 2022. The Rights Issue will close on Wednesday, 26 October 2022 (unless extended).

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Carly Holdings Limited

About Carly Holdings Limited

Carly Holdings Limited (ASX:CL8)investors.carly.co/ is listed on the Australian Securities Exchange. It is Australia’s leading listed company focused on providing innovative mobility solutions for consumers and the automotive industry. Carly Holdings operates www.Carly.co, Australia’s first flexible car subscription service.