ASX ANNOUNCEMENT

30 AUGUST 2022

CARLY RELEASES FULL YEAR RESULTS

Carly Holdings Limited (ASX:CL8) (Carly or the Company) is pleased to present its Appendix 4E and Annual Report for the year ended 30 June 2022 (FY22).

Carly Holdings ended FY22 with a strongly targeted focus on revenue opportunities in the car subscription market, securing of asset finance facilities from top-tier financiers to support growth in fleet size and successfully implementing the hybrid vehicle supply strategy. This strategy has seen vehicles added to the fleet at a faster rate and deliver increased revenue and gross profit.

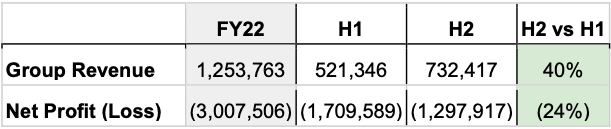

Significant improvements were recorded in revenue metrics in FY22 as compared to FY21, despite key markets of Sydney and Melbourne being impacted by movement restrictions due to Covid-19 lockdowns.

- Total Revenue increased by 26%

- Subscription Revenue increased by 84%

- Subscription Revenue from Owned and Leased Vehicles reached 31% of Total Revenue compared to zero in FY21.

- Net Loss From Continuing Operations declined by 10%.

The transition from the more seasonally volatile and Covid-19 impacted rental and rideshare rental revenue streams, towards car subscription continued in FY22, with Subscription Revenue contributing 89% of Total Revenue in FY22 vs 60% in FY21.

Active subscriptions continued to increase during FY22 and the average retention period remained above 5.6 months for the entire year. As Carly grows, it is delivering material increases in revenue and gross profit through successful implementation of price increases, upselling to higher value subscription plans and retaining an increased share of the subscription transaction value from owned and leased vehicles when compared to ‘asset-light’ vehicles (i.e. vehicles owned by third parties). Average Subscription Revenue and Gross Profit per Subscription increased by 16% and 14% respectively in June 2022 compared to June 2021.

Carly has traditionally operated an exclusively asset-light vehicle fleet, where third party owners provide vehicles in return for owner fees. Since Covid-19 caused global disruptions to vehicle supply, Carly leveraged its data and experience associated with in-demand vehicles and commenced purchasing and leasing vehicles to access more vehicle supply channels and meet the increasing demand for car subscription services. This strategy has been very successful to date, with owned and leased vehicles generating substantially more revenue and gross profit per vehicle compared to vehicles in the asset-light fleet. The owned and leased vehicles continue to perform at a higher utilisation than initial expectations, achieving 89% utilisation in H2. The success of the owned and leased fleet strategy emphasises the benefit of securing asset finance facilities to more rapidly expand the fleet size to support accelerated revenue growth.

Prior to the introduction of owned and leased vehicles in the June 2021 Quarter, Subscription Revenue comprised 35% of Subscription Transaction Value, increasing to 43% for all of FY22 and reaching an all-time high of 51% in the June 2022 Quarter. Subscription Revenue is increasing at a faster rate (112% increase in June 2022 Quarter compared to June 2021 Quarter) than Subscription Transaction Value (47% increase in June 2022 Quarter compared to June 2021 Quarter) due to the acquisition of owned and leased vehicles, as the entire Subscription Transaction Value is retained as revenue by Carly, as the vehicle owner.

In June 2022 Carly secured a new asset finance facility from a top-tier automotive financier to support the acquisition of an additional 60 to 65 vehicles. There was no benefit reflected in the FY22 results from this facility as no vehicles had yet been secured. Despite difficult conditions in accessing the supply of new vehicles, the Carly team have been able to successfully place numerous orders and since late July 2022, 12 vehicles have already been received (with the majority already out on subscription), with another 41 to be delivered between September and November 2022. The facility has capacity for another 10 to 11 vehicles. The new finance facility is in addition to the purchase of 16 vehicles and the leasing of 39 vehicles during FY22. This facility substantially increases the size of the owned/leased fleet.

Per the Company’s presentation (released to ASX on 23 June 2022), based on a utilisation rate of 85%, Carly receives on average, approximately $3,559 gross profit per annum from these financed vehicles compared to $2,115 gross profit per annum from “asset-light” vehicles. Carly is currently also achieving average utilisations above 85%.

Carly is in advanced discussions with financiers for further asset finance facilities, which have proven to be the optimal method to secure vehicles in a tight supply environment and deliver maximum gross margin. In support of this objective, Carly appointed Mike Mobilia as CFO in May 2022. Mr Mobilia is a highly entrepreneurial individual with a very strong asset finance background, having held the CFO and GM Group Risk roles at Equigroup. He has significant experience in asset finance funding structures, having financed billions of dollars of assets through various structures including receivable sales and P&A funding, as well as securing residual value funding.

With a solid product proposition, access to asset finance and improving metrics, Carly is well positioned to scale the business in FY23 and beyond.

The Company plans to hold the 2022 Annual General Meeting on 17 November 2022. The deadline to receive director nominations is 23 September 2022.

This announcement was authorised to be given to ASX by the Board of Directors of Carly Holdings Limited.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Collaborate Corporation Limited

About Carly Holdings Limited

Carly Holdings Limited (ASX:CL8) investors.carly.co/ is listed on the Australian Securities Exchange. It is Australia’s leading listed company focused on providing innovative mobility solutions for consumers and the automotive industry. Carly Holdings operates www.Carly.co, Australia’s first flexible car subscription service and www.DriveMyCar.com.au Australia’s leading peer-to-peer car rental business.