March 2023 Quarterly Activities Report and Appendix 4C

ASX ANNOUNCEMENT

26 APRIL 2023

MARCH 2023 QUARTERLY ACTIVITIES REPORT

Carly Holdings Limited (ASX:CL8) is pleased to present its consolidated cash flow report and business update for the quarter ended 31 March 2023.

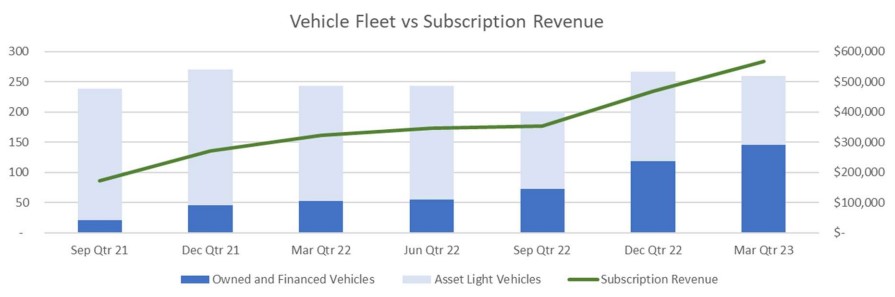

Carly has continued to deliver on key objectives, achieving a material increase in fleet size while maintaining high utilisation which delivered a 76% increase in subscription revenue YOY.

Following on from a strong December 2022 Quarter, subscription revenue increased by a further 21% in the March 2023 Quarter.

The securing of an asset finance facility of up to $10 million on 22 March 2023 was a major milestone and positions the business well to continue this growth trajectory.

Key highlights include:

- 76% increase in Subscription Revenue vs March 2022 Quarter and 21% increase vs December 2022 Quarter

- Average Monthly Subscription Revenue reached $189,000 per month in the quarter ($156,000 December 2022 Quarter) – a new record for the business and represents an Annualised Run Rate of $2.5 million (based on $209,000 Subscription Revenue in March 2023). The Annualised Run Rate reported in the December 2022 Quarter was $2.0 million

- Ongoing focus on cash management, with a 0% change in Net Cash Used in Operating Activities vs December 2022 Quarter, despite sales performance related incentives

and half year statutory costs paid in the March 2023 Quarter - Subscription Vehicle Utilisation increased to 88% across the March 2023 Quarter (87% December 2022 Quarter), despite the addition of new vehicles, demonstrating Carly’s ability to quickly fulfil subscriber demand

- Ongoing growth in the size of the owned and financed vehicle fleet, reaching 146

vehicles at the end of the March 2023 Quarter, an increase of 175% since the March 2022 Quarter - 16% decrease in Product Manufacturing and Operating Costs vs March 2022 Quarter and 17% decrease vs December 2022 Quarter

- 19% decrease in Advertising and Marketing vs March 2022 Quarter and 17% decrease vs December 2022 Quarter

- Secured asset financing of up to $10 million from iPartners in March 2023, with initial drawdown of $700,000 at the end of March facilitating the delivery of 28 vehicles by 20 April

- Continued to place forward orders to acquire vehicles during the June 2023 Quarter

Subscription Revenue increased by 21% compared to the December 2022 Quarter driven by upselling to higher value subscription plans, continued growth in the number of subscriptions and an increase in the number of new 2023 model vehicles.

The business strategy to increase the number of owned and financed vehicles, which deliver higher average margins than asset-light vehicles, continues to deliver a proportionally higher contribution of revenue. Owned and financed vehicles comprised 56% of the fleet at March 2023, compared to 45% at the end of December 2022, while contributing 68% of subscription revenue during the March 2023 Quarter, increasing from 57% in the December 2022 Quarter. Carly continues to engage with asset-light vehicle providers with a view to the ongoing development and growth of the asset-light fleet

Asset Finance Facility of up to $10 million Secured to Continue Fleet Growth

Carly is focused on developing a portfolio of owned, financed and asset-light vehicles in order to have a range of options to access vehicles during different market supply situations, as well as to achieve better control over vehicle availability and fleet size. As announced to ASX on 22 March 2023, Carly successfully closed its largest ever asset finance facility, with iPartners providing up to $10 million of vehicle financing, which if fully drawn down, would enable the purchase of up to 450 vehicles which would generate approximately $4.7 million in annual revenue @ 87% utilisation. This is in addition to the existing annual revenue run rate of $2.5m, which itself increased by 25% in the March 2023 Quarter.

Across the March 2023 Quarter, Carly added a further 27 new vehicles to its fleet, fully utilising all of the finance facilities available prior to the signing of the iPartners facility. Despite the addition of these new vehicles, Carly was able to achieve a vehicle utilisation rate of 88% during the March 2023 Quarter. With access to the iPartners facility, Carly will continue to balance the growth of the fleet with the aim of maintaining a vehicle utilisation rate above 85%. This approach will ensure that the business optimises its marketing spend and maintains a low vehicle storage cost for under-utilised vehicles. Despite some ongoing delays with the importation of new vehicles into Australia, Carly continues to work closely with its dealer network in placing forward orders in the June 2023 Quarter. 28 vehicles have already been delivered under the iPartners facility since 1 April 2023 ensuring ongoing growth in the Carly fleet.

In implementing this strategy, Carly continues to experience an improvement in both the

growth of subscription revenue and transaction value and a reduction in the average marketing cost, per subscriber. Overall, Advertising and Marketing Costs decreased by 19% compared to the March 2022 Quarter, despite a larger fleet size and growth in the subscriber base in the March 2023 Quarter

These latest results show that Carly is continuing to demonstrate success in three key

objectives:

- Securing asset finance facilities that support growth in fleet size

- Securing supply of vehicles in a timely fashion that are then highly utilised

- Increasing overall Subscription Transaction Value and retaining a higher proportion as revenue.

Cash flows during the quarter included payments for:

-

Research and development costs of $265,000 (YTD: $798,000)

-

Product manufacturing and operating costs of $479,000 (YTD: $1,671,000)

-

Advertising and marketing costs of $39,000 (YTD $132,000)

-

Staff costs of $477,000 (YTD: $1,226,000)

-

Administration and corporate costs of $100,000 (YTD $280,000)

-

Leased vehicles comprising:

- Interest amount of $42,000 (YTD: $81,000)

- Principal amount of $136,000 (YTD: $306,000).

Further details of the cash flows of the group are set out in the attached Appendix 4C.

Corporate

Payments to related parties and their associates in the March 2023 Quarter of $112,000

related to remuneration of the executive and non-executive directors for the period.

Cash Balance at Quarter End and Funding

At the end of the March 2023 Quarter, the Company maintained a cash balance of $962,000, a decrease of $656,000 from the December 2022 Quarter. During the June 2023 Quarter, the Company is expecting to receive an R&D Tax Incentive refund for the FY22 financial year and annual profit sharing contribution from the favourable claims loss experience for the motor fleet insurance policy. The aggregate of these cash inflows is forecast to be approximately $180,000.

The Directors closely monitor cash flows and funding requirements and are assessing all funding alternatives to ensure that the Company can continue to pursue the growth opportunities of the businesses. The Directors are very conscious of the cash flow requirements of the Group but also seek to ensure that funding is accessed at appropriate valuations so as to preserve value and limit dilution for all shareholders.

Authorised by:

Chris Noone

CEO and Director

Carly Holdings Limited

For more information please contact:

Chris Noone

CEO and Director

Carly Holdings Limited

E: shareholder@carly.co

About Carly Holdings Limited

Carly Holdings Limited (ASX:CL8) investors.carly.co/ is listed on the Australian Securities Exchange. It is Australia’s leading listed company focused on providing innovative mobility solutions for consumers and the automotive industry. Carly Holdings operates www.Carly.co, Australia’s first flexible car subscription service.